I have updated this post several times since first publishing it in 2018. Scroll to the bottom half for all the recent updates on hair loss company stocks since 2020.

However, this week there is a far bigger story and phenomenon at play. One that could have huge implications on the stock market, overall economy and power of the much maligned hedge funds and billionaire class. Will David at least permanently dent Goliath in this battle?

The rise of WSB and YOLO Meme Stock Investing in 2021

This week, the stock market has witnessed insanity in the form of GameStop (GME) and its short squeeze. Courtesy of Wallstreetbets (WSB) and the idea that you only live once (YOLO). i.e., do not trade and hope for 8 percent annual returns so as to retire in comfort in decades. I can see the logic in both ways of thinking and living one’s life.

Note that many of the small-scale traders on WSB have other far larger societal goals. They want to collaborate and hurt large billionaire investors and hedge funds who make money of shorting stocks. The latter often do so with ulterior methods and access to illegal insider information.

While I am not a day trader, I got back into the stock market in the middle of 2020 due to good buying opportunities. Once I made all my purchases, I was hoping not to check any of my balances for a year. At that point, I could sell some stocks and avoid high capital gains taxes.

However, this 2021 phenomena of massive-scale collaborative purchases by small-scale investors (via discussions on platforms such as Reddit, Robinhood and Stocktwits) has me hooked.

Even hair loss sufferer Elon Musk got into the GME frenzy via Gamestonk.

It seems like YOLO meme stocks are here to stay and the SEC cannot do much about this phenomenon for now. Edit: Looks like this could change as GME stock went up almost 150 percent today. Biden team monitoring. Also, a number of platforms limited trading in GME and other such stocks on January 28th. Robinhood got a beating for doing so in the media.

I do enjoy seeing some of the short-selling hedge funds being clobbered by a bunch of Redditors. But ultimately, I fear a whole bunch of young inexperienced investors losing all of their savings in this almost pyramid scheme type game.

Too bad our favorite micro-cap hair loss companies are not in the radar of these WSB fanatics/trail blazers. Social media has become a big deal in influencing stock prices of smaller-sized companies. Unfortunately, Replicel is not getting any respect and complained as such yesterday. Meanwhile, Histogen’s stock price has almost doubled since the beginning of 2021.

Balding Investors Saving for Hair Cloning

Almost every week on this blog, at least one person discusses the stock prices of hair loss companies that are publicly traded. Same goes for our hair loss chat. Considering how expensive hair cloning or hair multiplication will be (e.g., Dr. Takashi Tsuji and what could have been), many of us will need to hit the jackpot.

I wanted to write this post for many years, but there were some issues that prevented me from doing so:

- Is it worth covering companies such as Allergan, for whom hair loss related products represent a tiny fraction of overall revenues? i.e., unless they come out with a truly game-changing hair loss cure, their stock price will never be affected significantly by any new minor hair loss treatment product.

- Does it make sense to include the numerous companies working on alopecia areata (AA) related treatments? The vast majority (over 95 percent) of hair loss patients suffer from androgenetic alopecia (AGA). A condition that is also known as male pattern baldness or female pattern hair loss.

- What about pharmaceutical companies working on brand name or generic versions of existing products such as Finasteride, Dutasteride and Minoxidil?

- How about manufacturers of products such as laser hair growth caps, combs and helmet devices? Or even hairpieces, shampoos, concealers and so on.

- How about companies involved in the manufacturing of hair transplant related tools and devices? Especially hair transplant robots such as ARTAS?

For the time being, I am only including companies that are of most relevance to our ultimate goal of a hair loss cure. Perhaps I will modify this in future if a company develops a moderately effective hair loss product. Some currently privately-held companies (e.g., Samumed or Dr. Tsuji/RIKEN partners Kyocera and Organ Technologies) will be added to the below list if they go public.

It seems like we regularly see situations where a company makes a big positive announcement about its hair loss product development, only to see little change in its stock price movement. Or sometimes even an unexpected decline in its share price despite the good news. Finance and investing experts among this blog’s readers can try to explain such developments when they occur.

Hair Loss Company Stock Prices

Aclaris Therapeutics (ACRS) — Perhaps of most interest during the past year. Fast moving relatively new US-based company that is working on both AA and AGA treatments. 2020 Update: Not true anymore :-(

Allergan (AGN) — Working on a number of hair loss products such as Bimatoprost and Setipiprant. Hair loss segment accounts for a small portion of overall sales. Headquartered in Dublin, Ireland. 2020 Update: Allergan invested in several other new hair loss companies in 2019. More importantly, they invested in Stemson Therapeutics in 2020.

Cassiopea (SKIN:SW) — Its Breezula (formerly CB-03-01) product is causing some excitement in 2019 per one of my industry contacts. 2021 Update: Their closely related acne product Winlevi will be released in the US in 2021.

Conatus (CNAT) — A new entrant in 2020 after its merger with Histogen. Edit: Seems like Histogen (HSTO) is still also traded separately.

Follicum (FOLLI:SS) — Highly professional Swedish company, with its main area of focus being on its hair regrowth product. Follicum’s Phase 2 clinical trials will be completed in 2021.

L’Oreal (OR:PA) — World renowned cosmetics leader headquartered in France. They are working on 3D printed hair and grey hair reversal treatments.

PolarityTE (PTE) — Previous ticker was “COOL”. If their skin product succeeds, only a matter of time before this US-based company develops a hair loss product. Extremely fast moving new company with highly experienced and qualified key staff members. 2020 Update: PolarityTE common stock offering. Unfortunately, the stock price plummeted almost 50 percent today after that news.

PureTech Health (PRTC) — Although headquartered in the US, they are listed on the London Stock Exchange. Their hair loss segment is represented by Follica, which has been teasing us for over a decade. But is expected to commence Phase 3 trials in 2021.

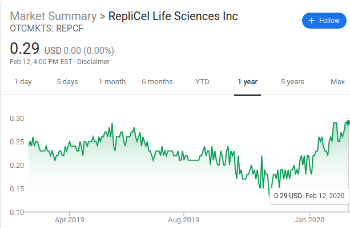

RepliCel (REPCF) — A Canadian company that has been in the news in the hair loss world for a decade. Replicel’s drastically larger Japanese partner Shiseido (see below) is of much more interest to us when it comes to a hair loss treatment. However, for speculators and day traders, Replicel may be an interesting play.

Shiseido (SSDOY) — A Japanese cosmetics behemoth that is especially significant in Asia. Basic adenosine based adenovital shampoos and other related products represent a major portion of their overall sales. Besides working on a hair loss cure based on Replicel’s technology (with marketing rights in Asia), Shiseido also has its own highly experienced in-house hair loss research team.

Disclaimer:

I am not a financial advisor or finance professional. As of the time of publishing this post, I do not own shares in any of the above companies.