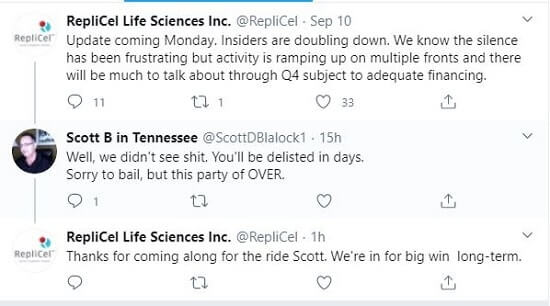

Update: September 15, 2020 — For the past week, there has been a lot of online discussion about Replicel (Canada)’s collapsing stock price. REPCF is at 10 cents per share as of today, down from 30 cents just 6 months ago. A few days ago, Replicel’s Twitter account posted a comment that garnered a number of responses. My favorite interaction came today:

For several years, I have assumed that Replicel’s technology will only come to fruition if Shiseido decides to go through with it. The two semi-partners have had an ongoing dispute related to rights and clinical trials for several years. Shiseido is a cosmetics behemoth that is 100s of times as large as Replicel.

Replicel Update on Shiseido Partnership

Earlier today, Replicel also released a detailed update that included further elaboration on its Shiseido partnership problems:

“The disagreement regarding the status of the agreement between Shiseido and RepliCel remains unresolved, but is not the subject of any litigation or arbitration. RepliCel maintains the Agreement remains intact and is communicating with Shiseido its expectation that (a) they deliver to RepliCel the full clinical data set from the recently completed study of RCH-01 in Japan and (b) confirm that their license agreement remains intact without breach. RepliCel reserves the right to take the position that Shiseido’s failure to deliver the clinical data from the recently completed clinical study in Shiseido’s Territory constitutes a material breach of contract which, failing a cure, will warrant RepliCel’s termination of the agreement.”

Not very encouraging. It should be noted, however, that Shiseido has its own Japanese scientists and researchers that have been working on hair loss treatments for decades. I have written many posts on this company since this blog started. Hopefully, Shiseido can still produce a great treatment for androgenetic alopecia, even if unable to use Replicel’s technology. And vice versa of course.

RCH-01 Phase 2 Trials Status

Replicel also stated the following in its update:

“RepliCel will begin preparations for phase 2 human clinical trials of this product outside of Asia (Shiseido’s licensed territory).”

The company is in early stage discussions with potential partners outside of Asia. It seems like Replicel will always need to look for funding at each stage of trials. CEO Lee Buckler tends to post regular updates on Twitter regarding new partnerships.

March 23, 2020

RCH-01 Update

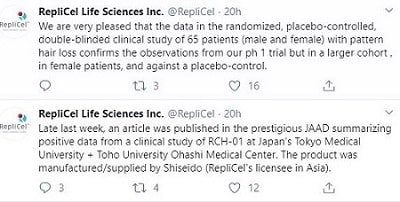

Replicel just published a slightly encouraging update on its RCH-01 product for hair loss. Well known dermatologist Dr. Jerry Shapiro has high praise for the recent Shiseido trial in Japan. He makes an astute point that most of the patients in the trial were at advanced stages of hair loss. This makes the results even more encouraging for those with recent hair loss. For transparency, the update does mention that Dr. Shapiro was a founding shareholder of Replicel.

The autologous cell-based therapy with dermal sheath cup cells that was used in the Shiseido study is the same product that RepliCel refers to as RCH-01:

Shiseido has licensed the co-development and commercial rights in Asia. RepliCel maintains the complete and unrestricted rights to this product outside of Asia.

Also of interest and something that I missed before: the Shiseido trial proved that the RCH-01 dermal sheath cup cell product can be used after cryopreservation and thawing.

March 11, 2020

Replicel updated its Twitter feed. It seems like the latest Shiseido trials used Replicel’s RCH-01 technology. A bit strange that Shiseido does not mention Replicel in its latest communications. Perhaps indicating that the two companies’ partnership issues are not yet close to being resolved.

Yesterday, Replicel also got good news from the Japanese regulatory agency PMDA. This was in regards to the issuance of several non-hair loss product related patents. And Replicel got a final consultation go-ahead today regarding the company’s skin and tendon regeneration products.

Replicel’s stock price is even more volatile than usual this week. It dropped 33 percent on Monday. Then increased 71 percent on Tuesday. Down 10 percent so far today.

Replicel Stock Price

May 26, 2019

For those who are in the finance sector, why has Replicel’s stock price declined so drastically and continuously during the past five years? Earlier today, the company made yet another positive press release. This time regarding its YOFOTO licensee in China and its decent growth prospects.

This comes on top of the two announcements that they already made earlier this month. If any of this blog’s readers is investing in REPCF stock, please update us regularly on any developments. Including insider transactions, earnings announcements, P/E ratios and more.

Buy buy buy!

Yes. Looks like a classic buying opportunity. I used to follow a penny stock company called “Current Technology ” which was working on a hair loss treatment based on electrical stimulation. Buying and selling on ups and downs was an easy moneymaker for me because so few people followed the news. It was a huge advantage. This stock looks exactly the same to me.

Because the investors got no news as times goes by and they are not dumbs decided to put money in better things

2011 Replicel: (Hype)

“RepliCel anticipates initiation of its Phase II study in the second half of 2013 which will be followed by a Phase III trial. The timeline to a commercial product depends on the execution of these trials and regulatory approvals. Nevertheless, if the technology proves safe and effective, RepliCel anticipates that a commercial product may be available in 2015 in non-Western jurisdictions.”

2015 Replicel: (Delays)

“We were preparing for the next phase and the culture media that the team had grown those dermal sheath cups cell in was pulled off the market.” — “General Electric decided not to make any culture medium, so we had to find another source, and this is not that easy. This took us a long, long, while and is one of the major reasons for this delay.”

2018 Replicel: (N/A)

—R.I.P.-licel stock

It’s all about money. 99% of all these biotech companies promising a baldness cure are ways to make the shareholders richer. In other words, they are all shady guys, promising and delaying stuff just to get more financing from dumb people.

My advice, invest in these biotech at their early stages and try to take some profit. With these profit, go get a FUT. Best scenario I can suggest to you guys. Or build a biotech, sell dreams and become rich.

– Gecko

Hey Admin shouldn’t Polichem be coming to market by summer?

Not sure :-(

I’ll say it once and I’ll say it again. Our hairlosss industry is a joke. If follica fails then screw it. I don’t see tsuji delivery for many years. Sisheido will probably just maintain with repeat injections needed every couple years. SM, Follicum will maintain but 10% regrowth at max, Riverton probably same thing. Histogen, who knows and jak, good regrowth but sides may be an issue since it’s immunosuppressive drug. I hope im wrong on my predictions but the last 20 years shows the same scenarios of failures.

LOL – are you serious? Look at the volume – this is a boiler room stock, sold by cold-calls made by kids who just got their Series 7 (but may not have gone to college – seriously). In addition to that ridiculous chart, there have also been several “private placements” along the way, further diluting the share price. Replicel is basically a zombie company that exists solely to pay its overhead, nothing more. The C Suite will ride it out as long as they can, periodically trying to pump the price with silly tweets in an effort to keep the party going. Once the stock drops below 15 cents or so and the volume drops to nothing, that will be it – they’ll declare bk, fold up ship, sell off whatever assets they have left, and go start another company.

But if what you say is true, how did they manage to fool Shiseido and YOFOTO? And their initial clinical trial results also seemed reasonable.

I didn’t say they are a fraud, I said they aren’t a real biotech company. They took a promising piece of tech, did a great job of licensing it BEFORE TRIALS, and now they have nothing else to sell except some sort of injector that no derm is going to pay for when it offers little benefit over a .99$ hypodermic needle. Do you think “irrational exhuberance” is limited to internet companies? And btw, the Japanese are TERRIBLE businessmen – you could write a multi-volume tome on all the bad deals major Japanese corporations have made in the last forty years. Japan has had the longest stagnated economy in modern history for a reason – they don’t know how to conduct business with the rest of the world (unless they have an army of Americans/Euros doing the heavy lifting for them, which is why all the Japanese car brands have C Suites filled with anglos). Replicel either made a hell of a pitch and sold an unproven tech to a gullible Japanese company, or simply got lucky by benefiting/exploiting the language and legal barrier (the Japanese are probably the worst English speaking Asians in all of Asia – even South East Asians like Thais and Vietnamese speak better English than the average Japanese). The belief that Japan is a techno superpower is a forty-year-old anachronistic myth that itself was never based in reality. Japan is a great nation with a great culture, but they are significantly behind the rest of the advanced world in many critical ways. If I had the time and inclination, I’d go into more detail, but basically they need a new Meiji Restoration-like period of expansion and adoption of foreign behavior if they ever hope to counter China (forget about our competing the Chinese – they will never, ever be able to do that). Their country literally depends on it – once China take Taiwan, Japan is next, and the Chinese will never, ever forget nor forgive Nanjing.

Lmao. Dude really? I cant stand behind everything said here some of it is just like ….dadditude to the max.

Japan is technologically advanced homie! especially in biotech. Am I full of it? Yeah? Ok who discovered ip stem cells? A japanese scientist. Lol who discovered damn CRISPR in 1987 that influenced doudna? A japanese scientist. What about Blockchain? Kid rock? No satoshi nakamoto.

Like ..c’mon dad. Talking about meiji and pearl harbor lmao.

Great ad hominem attacks full of anecdotes, bro, totally solid rebuttal checks out. But what about that world’s longest stagnated economy? And that birthrate and dat debt to GDP, tho – 234% is high AF LOL! And the birthrate and the Lost 20 Years ¯\_(ツ)_/¯

Nihongo ga wakarimasu ka? Watashi wa wakrimasu. Ever worked in finance IN JAPAN? This isn’t a conversation you’re going to win.

Lol Calm down dad, you win. I haven’t worked in Japan as a financial analyst tu chet. however I’m very aware of all the kyle bass type economic factoids you mention and find it irrelevant to their technological progress still holding firm on the Japan is technologically advanced nation. To say they are not is hilariously absurd to me.

Your a card I enjoyed the e-fight. Smart guy but beg to differ.

Sorry weebo, but Japan isn’t like anime. For people other than this know-nothing, the real Japan is like as if technology continued to progress in a linear fashion from 1989, sans internet. They still make decent hardware, but they didn’t and still don’t have a clue about what the internet is and does (name a single major Japanese internet service company that has a following outside Japan), and now the ROKs are breathing down their necks on everything from chips to displays (actually, they have far surpassed Japan in just about everything, especially displays and – more importantly – batteries). But you got me! I’m probably 15 years older than you, so everything I’ve said is wrong, even though I’ve actually lived there, worked there, speak the language, and the closest you’ve come or will ever come to understanding Japan and the Japanese mindset is the fan service sub on 4chan. And it’s “you’re,” dummy.

haha i like this guy

K you win dad calm down. My twin brother speaks Japanese fluently and lived there too and he’s an idiot. Your references are irrelevant to hairloss technology ….were on a bald guy forum right now btw …you sound either drunk insecure or missing the good ol days at my expense. It’s cute but i could care less. Japan has a strong scientific presence on this planet if you disagree your in another world. bark on at anyone in biotech dealing with genomics stem cells and bioinformatics about Japanese incompetence bad battery tech and GDP woes requiring a meiji restoration with little technological contribution to the world they’ll think your a crabby old man that walked out of a homeless shelter. Because their dumb young Mellienials right? We can drop the cliche. And how about “ur” ….see no one cares. …and if it makes me look stupid it’s because I’m to lazy to fix my cell phone spell check and don’t care DAMN they think egghead is dumb now I was on such a roll. Lmao.

……….Sorry I’m 3 beers in and bored af.. got off topic……. where were we? .. Oh yes! the Meiji restoration. Lmao

everytime I hear that word from now on I’m gonna think of this dumb ass hilarious internet argument admin keeps Approving.

Btw I love u for that admin lol good times.

https://en.m.wikipedia.org/wiki/Timeline_of_Japanese_history

C’mon dad let’s take this argument to the next level

You sound like a Chinese hating on Japanese. You forgot how Japan held China by the scruff of the neck?

1. Arguments with Shiseido don’t help.

2. Delaying further clinicals until the release of their injection device doesn’t help.

3. How old are they and they still are only phase 1 completed?

4.Also if I recall their results are 5% or so regrowth?

4a. Kerastem like regrowth does not spell commercial success.

4.Their success commercially if they release would be predicated on their dpscs being able to stop future losses.

I’d love to see them succeed though. That would be just ducky. Depending on the price point I might even be willing to fly to japan to get their treatment just for the 5% regrowth. I haven’t really looked at their numbers recently honestly though.

Why is the injector so important to replicel’s RCH-01?

From replicels site:

Overall benefits:

Delivery of a variety of injectable substances

Enables broad, shallow injections for fine wrinkles

Increases precision and ease of application

Improved control and delivery

Comfort grip for ease of use

Increased surface area coverage

Quicker procedure times

Reduction in use of local anaesthetics

Less pain and bruising

Improved consistency of results

Speculation:

Future RCH-01 trials stand to benefit greatly from this injector.

1. Will make trials more affordable by reducing physician time

2. Improved RCH-01 results due to parameterized depth, number of injections(Improved dispersion) and volume.

Isnt it obvious ?

“THIS” company keeps “anticipate”, “foresee”, “speculate”, blah blah blah and keep bragging on tweeter WITHOUT anything in their hands.

Gotta see some sales first right now they make nothing and borrow everything.

Hopeless… Fina and Minox will remain the only option for many years to come:(((

Cash flow is negative, EPS is negative, liabilities are way more than assets, probability of successful launch of their products is lesser.. , research has not turned into development yet, i would buy the stock only if some development of products takes place even if i will have to buy the stock at higher prices. Mutual funds have to give their members return, they cant invest for long term in such stocks. And there are better opportunities to invest.

Hey guys,

Again it may be good to focus on polichem for now.. and breezula will have its acne counter part out next year I believe which is just a lower dose.. input welcome…

Richieron you are Right! I also wait for Polichem to come out any time now. And Mamybe Medipost. And for Winlevi I wonder if a compounding pharmacy could mix a higher dose of it. Then we would have Breezula next year already …

Honestly these are the most reachable treatments that are drawing very close.

The share price is reflective of the fact that time is running out for Replicel. If you were an investor 15 years ago, your only question would be “will this work?” Today your question will be “will this get there first?”

Even if Shiseido surprises us with good results, Aclaris or Riken could blow them out of the water. And the same applies to them.

Most of these comments should qualify the posters to be on CNBC! Seriously admin, what was the point of this question? It would mostly encourage whining, although I guess I’m whining about the whining!

Mostly to help me learn about finance from others instead of from Google:-)

Still surprised at the almost continuous fall in Replicel stock for 5 years.

A few of the comments meet your criteria but guess that’s true of most posts on blogs and forums. At least no one is b…… about sides from Replicel stock! :-)

Market cap divided by circulations = price

Simple math. Try crypto or stocks.

Not saying this will happen but If Shiseido released images of a full blown indisputable cure that rocked world media outlets and obviously replicels name being touted. Their today 6 million Market cap would be waaaaaaaaaaaaaaaaaay more than 6 million. Try uhh I don’t even know… make up a number! and calculate that price. 60mill $2 600m $20 Dilution is a historical pricing event but you can accurately calculate price via mktcap/circulating units.

Just. If you hear anything be ready to click.

Otherwise it’s probably a flop lol.

I hope Tsuji won’t be in the same boat as replicel otherwise we are f…. :/

Winlevi Positive Results Phase 3

http://www.cassiopea.com/news-and-media/press-releases/yr-2019/190326.aspx

I bet winlevi will work for aga. Blocks androgen receptors. If it absorbs into the face for acne then it should absorb into the scalp. Both skin surfaces have hair follicles. In theory it should have some effect of stopping mpb. If it comes out next year I’ll buy it and apply it on my temples. Wouldn’t be shocked to see hairs sprout. What is everyone’s thoughts on winlevi. Aren’t the receptors at the same depth with the face and scalp since follicles are present on both parts ?

Mjones Same for me. I will try it when available. I still wonder if compounding pharmacies could deliver Winlevi in higher doses which is then Breezula. That could be a great Treatment in 2020 already.

https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&cad=rja&uact=8&ved=2ahUKEwjr8N_OjKbhAhVpxMQBHdhrAUwQwqsBMAF6BAgJEAQ&url=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3D-AVYVJVXFoo&usg=AOvVaw0V2VePpb-nNRA-ppuJ_qPb

You should be careful when evaluating only share price without taking into account the change in number of shares over time, I think a better marker in this case would be market cap which can be seen here:

https://ycharts.com/companies/REPCF/market_cap

according to share price drop is (~): from 6 to 0.25 (ie: need x24 to get back to previous position)

according to market cap drop is (~): from 30m to 6m (ie: need x5 to get back to previous position)

Cheers

Thanks “RA”!

Even then the REPCF cap has been artificially inflated by several private placements since it went public. There were several times when REPCF’s cap was under $3m, then suddenly went back up to over $6m (only to deflate again after REPCF spent money on…what?). How does this happen? Private placements – it had nothing to do with the stock’s improved performance, and in fact, it was the exact opposite as REPCF went out and sold shares off market to the “dumb money” crowd – people with means but no understanding of the market or how to conduct due diligence. REPCF has been doing this for years, simply to ensure that their C suite gets to take home their over-inflated paychecks (Buckler’s compensation package is with several hundred thousand dollars a year).

This company is DEAD. If the tech had any hope of working, it wouldn’t be a penny stock. RCH-01 has failed – it’s time to move on to late-stage therapies that actually have a chance and don’t depend on some pie-in-the-sky daydream about flying to Japan to get your hair back (and cancer to boot, if it even worked, which it doesn’t – there’s a reason most nations run THREE trials).

Not sure if anyone recalls but one of the things that has made me skeptical of Replicel, is that, in the run up to the release of their Phase 1 trial results, it became know that they had hired 1 or more companies to influence their stock price. Which of course they would never have needed to do if they knew their results were positive. Once the trial results were released, the stock price plummeted. I would put my money on the scenario that Boiler Stoker paints in his first post above.

And yet, Shiseido invested millions into building a purpose-built facility in Japan to finish their product and do the phase 2 test.

I am not saying you are wrong, mainly because as a balding guy I have a vested interest, but I am saying it is not as clear cut as just looking at the share price.

Big money investments means nothing thorn medical had 100M+ funding with really big names in British politics and that company was like damn Theranos …total b’s.

I do recall shiseido saying they had an alternative technology that required using replicel tech as a derivative. That’s the only thing that gave me hope because replicel phase 1 results were terrible. Replicel is a junk company but if shiseido pulls it off replicel wins big because they get to use that tech ebb everywhere excel out for Asia.. As perthe agreement hence the unfair advantage lawsuit

Meaningless; Elizabeth Holmes and Theranos conned many very smart VCs into shelling out $700 million and building a $10b valuation on a total sham technology. Fraud happens.

For all you REPCF cheerleaders out there, it’s pretty simple – just put your money where your mouth is. If RCH-01 works, REPCF will go from .20$/share to at least $50/share – one of the greatest equity appreciation stories in the history of the market. So dive in! Buy 100,000 shares, then get ready to hit the lottery in a year or two when RCH-01 releases! LOL.

The galaxy s19 will be out before a cure. I think the expectation should be something that gives 20% regrowth w out major sides or a tapering period of a drug where one does not have to be on it to maintain results, unless it’s another medical issue causing hairloss. I think in all reality that is the expectation.

Far as bald: Obviously the above wouldn’t help much…besides give somewhat spouse stubble shave look….then your betting hoarse is cloning. You think that truly happens in 2020? Be honest.

Flying to japan: Myth. I was just in surgical rotation 2 weeks ago….and robotic surgery for 1 machine is 1.2 million. These machines for surgery are like cell phones….not much upgrade year over year. However this is why leasing them can be a better option.

Why did I say myth. Well it could be. To or if surgery already is being talked about from remote locations. For instance by the time I graduate …surgeons could be doing a surgery in one city while staying in another. The problem is….western doctors have a high learning curve when it comes to ribotics. It will take time.

Is this server rigged to explode at midnight Jan 1st 2021 regardless if a cure does or does not come out?

Hi all- I am a fund manager so I will explain to hopefully relay the key points here.

Replicel has no sales so its forced to license IP for cheap and issue shares to get cash, but studies and salaries are quite expensive, so as they issue shares cash keeps depleting as well. So imagine a company’s present value from all future earnings is 1 billion. If they double shares then the original shares would only be worth only 0.5 billion. If the double shares again then the original shares would be worth 0.25 billion and so on.

The main issue with repli and most R&D early stage stocks is simply not having any operating profit while at the same time having large expenses so its a bank account shrinking combination. This history happens to most rd early stage companies by the way even the ones with good tech. Even companies like tesla can struggle with the cash needs required by high rd costs in the face of negative operating profit. I do own a tiny amount of repli, but without any significant cash or sales to generate cash from its hard to negotiate good deals or fund studies. Thats is why they seem to be prioritizing the injector. They need cash and obviously selling stock for pennies is not a cheap source of funds

Makes sense! Thanks Hairplz.

Uh, you left out the VC story – if REPCF had anything, they would have had VCs falling over one another for round after round after round of funding. There are several ways to raise money – diluting shares through penny stock sales is the worst. If REPCF had anything, they would still be a private company, and would have never gone public just to so they could license their tech. Instead, they would have raised hundreds of millions from VCs, which they would have used to fund their own trials, and then go public AFTER they finished III trials.

And I’ll add this – the latter model is EXACTLY what Follica is doing. It’s a private company funded by a major public biotech that is footing the bill for the trials. If the trials work out, PureTech gets a massive piece of the pie. THAT is how a real promising therapy gets to market, and that is why Follica is probably the most likely candidate of all currently trialed therapies to make it to market.

Hundreds of millions? I wish it was that easy.. mankind would have all kinds of new treatments if having an idea with no effectiveness studies could bring in that much. Keep in mind vc dilutes as well

I do think ppl were expecting more from phase 1 and that has made it even harder to raise money. Shiseido being silent is also not the best of signs..

For JAKs … Well this sounds interesting:

Etienne C.E. Wang, Zhenpeng Dai, Anthony W. Ferrante, Charles G. Drake, Angela M. Christiano

https://www.x-mol.com/paper/5620839

Beep, Beep, Beep!!! Calling Nasa_RS, JAK Alert!!

The fact that it will be a topical Jak is interesting !

Remember intercytex? These companies exist to make money pretending to research and develop a product but never do. They milk the R&D phase until they run dry and off to a new company they go. Rinse. Repeat.

The cure will come from some random place we’ve never heard of, if it ever actually comes.

Bill Ace,

I tend to believe that cynicism. Companies put on a good show for venture capitalists, and 30% of the money ends up in off-shore accounts prior to closing up shop. Or… they’re legit, but they get paid off and squelched by the establishment hair transplant and wig industry. It’s so frustrating. We just have to hope a company really finds a way to bring something to market or that the cure is a side effect of a new skin growing company that happens to make hair follicles too. It’s about time we had some good luck. I remember Popular Science speaking of a baldness cure for 2009. Sigh.

I believe that for the moment no pharmaceutical company is interested in finding a treatment for gold mine diseases … unfortunately baldness is one of them … perhaps a better and more expensive treatment will come around some day, but for now they have other priorities and that’s not us…

Whatever happened to Kerastem trials? Anything new with that or is that just another bs prp

I was once very optimistic. I wouldn’t say that is all gone but I honestly don’t think we will be close to a functional cure till at least 2025.

Conclusive proof of Shiseido RCH-01 phase 2 with 30-55% extra density between each of the test subjects! To be released within weeks initially to clinics in Tokyo, Osaka and Hong Kong followed by a larger Asian roll-out plan.

I will have the document/presentation translated then post a link.

April fools?

Pretty sure it is :(

Hahaha

If you had excluded Hong-Kong, it’d have been more believable.

Hahaha

Lame.

Gentlemen please let us all hold hands and have a moment of silence for our dear friend Jeff bezos. The cunning man of mystery.

From an investment standpoint, RCS-01 (skin treatment) is the horse you should be betting on. Results from the trial indicate this will be Replicel’s best product by a country mile. Hair loss treatment is hard to say, but I wouldn’t get your hopes up.

That said, Shiseido and Replicel could be sitting on the biggest “Holy Sh$t” medical discovery since penicillin, waiting for their earnings announcement in May to tell the world.

Stock price volatility, even in sectors considered stable/”consumer-defensive”, is due to the covid-19 virus due to closures of stores in China and the disruption to supply chains. I have lost 15% off my stocks value even in “consumer-defensive” businesses that sell food or elec/utilities.

Replicel is a volatile company in a volatile sector in a currently volatile world. That’s like a jelly balancing on a jelly on another jelly.

Even with Corona spurred triple jelly, a one day 70 percent movement seems crazy considering that Replicel is a 10-year old company.

Not in the pharmacy sector prior to approvals being given or rejected. This is the territory where most investors dare not go.

Shiseido stock dropping

Sorry for going off topic, but can anyone offer advice on where they source finestaride in Melbourne Australia?

Many Thanks for your tremendous blog Admin

I had sides so I’m not on it anymore, but go to any doc. Most will prescribe it. Works out at AUD $90 per month a pack for brand name. Compounding pharmacies are cheaper. Sinclair Derm compound their own but the continual appointments end up being expensive. Dr Christopher Bagot at the Camberwell Road Medical Clinic is a good doc to see in Melb.

@Admin has Shiseido started the next trial?

Good to find this

does anyone know an online pharmacy where you can buy legitimate finasteride at a good price?

I would only go with trusted and verified companies. The only online company that I know of is ‘Pilot’ The other option is to see your local GP. I’m sure there are other online sites that sell it but who knows what your getting. If you want you the real deal finasteride then go with brand name: ‘Propecia’. I’m not saying generic finasteride does not work but from quality of ingredients, machines that make it, consistency, etc. there is a difference.

They tell us to wait thee years for something that has so very little efficacy? These kind of things make me go in a ultra pessimistic mode. How can we expect tsuji / stemson / tissuse, ecc to deliver the ultimate cure when other players just show how far behind the science actually is. I hope to be proven wrong so hard tho, I truly believe hope is the most important part and the only thing that helps us to cope with it, but they give us little reason to

Recent bad news aside, L’Oreal recently released a poster regarding hair cloning.

This means good news if this procedure will be available soon for an affordable price.

@admin could you find out some more about this please

No human trials started as far as I know :-(

Hey admin and y’all, can I get a bit of advice / encouragement?

I’ve been treating my hair on-the-cheap for about 6 years (just minoxidil—no better, no worse). I hoped to put all my money into a one-stop-fix or something superior (Replicel’16, Folllica’17, Hairclone, JAKS, Tsuji 2020! etc. something!)

Well, my dreams are dashed, or rather, they remain in this eternal 5-years away position. I’ve fully squandered my youth! I can’t get back the years. Perhaps I can get the hair.

( 1 ) I’m going to go on Finasteride. ( 2 ) I’m going to combine Micro-needling with Minoxidil (Liquid peels my scalp; I’ll try the foam) ( 3 ) I’m going to get a hairline transplant from Dr. Rahal.

What dose that cost? 5k+ (CAD) for an artistic, natural hairline? 1K grafts? How much do you suppose?Unfortunately, I’m still left with a diffuse top and no crown but perhaps by some miracle I can put the big 3 to use with the micro-needling and gain enough to conceal it. At least I’d have hair! This process could take 6 months to 2 years which will, by then, put prospective treatments closer in view.

How does that sound as a recovery plan? Could I ask for anything better? — Life at lowest-point. Feeling incredibly deflated. Any experience, advice, help, similar vent would be much appreciated! Anything. Sincerely.

Hi Toccata, see the table towards the bottom of the below post for reference:

https://www.hairlosscure2020.com/hair-transplant-cost/

I have never had a hair transplant to offer any advice about artistry or graft placement. I am hoping that exosome treatment turns out to be a lot better than PRP.

Hi Toccata. Sorry to hear you’re feeling so sh#t. I hear you. Many on here would sympathise I’m sure. Some days it feels like an endless roller coaster ride that fluctuates between hope and despair. It’s very easy for some-who’ve managed to regrow or halt their hair loss-to be smug and tell you to quit complaining, etc. But if you’re in the midst of the never ending cycle of worsening hair loss-it can seem overwhelming. Anyone who says ‘it’s only hair’ is full of sh#t. (They’re usually not experiencing hair loss, fixed the problem or they are bald and had horrid hair to begin with).

All I can offer in regards to assessing future treatments is this: First look at 1: Safety, 2: Efficacy, 3: Availability. 4: Affordability. This is a long road we are on. Things just take time unfortunately. It’s been 23 years since Fin was released. Min somewhere in the 80’s! I’m into surfing and if I look at surfboard design, it’s been 39 years since the 3 fin thruster was invented! Apart from epoxy more recently, it’s been 50+ years using the same old polyurethane and fibreglass construction. Things develop slowly it seems. I get frustrated too. (Especially with never-ending academic research funding that seems to go nowhere) However, you never know what the tide might bring? Maybe something from out of left field will come along and knock all others out of the park? In the meantime, maybe Dr Rahal is the way to go? I know what I’ve said will not make you leap around the streets with joy and exhilaration but we have to maintain some hope or we sink.

i gave up on replicel a long time ago in my opinion replicel is a joke that youtube video from 2012 of a animated guy regrowing a full head of hair to the results we got like last year is just sad. there are better players on this field and replicel is not on the field. i bet i’ll get a comment from jan can’t wait… lol ;)

I agree woofy97. They may have started out with a concept based on solid research from Kevin McElwee, but unless something changed, my understanding was that the dermal cup sheath cell was incapable of replication without losing all inductivity. And then it appeared they were trying to goose their stock price prior to disclosing the poor results of their only clinical trial. Now a partnership disagreement presumably because Shiseido feels Replicel didn’t live up to their obligation to launch their own clinical trial. So I think this company is low on integrity and low on cash. I see this latest attempt at spinning a wish list into getting more financing as a sign the end is very near.

Woofy hahahaha no comment today:D

The tweet says “Insiders are doubling down”. Unless I’m missing something that seems to be a lie according to:

https://www.gurufocus.com/stock/REPCF/insider

According to it their insiders haven’t bought stocks since 2017 ¯\_(ツ)_/¯

I’m sure many of you know this already but just thought I’d drop you update here anyway:

RepliCel Files Notice of Arbitration against Shiseido Company to Resolve its License Agreement Dispute Regarding its Androgenetic Alopecia Cell Therapy.

https://www.replicel.com/news/replicel-files-notice-of-arbitration-against-shiseido-company-to-resolve-its-license-agreement-dispute-regarding-its-androgenetic-alopecia-cell-therapy

RELEASE – RepliCel Terminates License Agreement with Shiseido

RepliCel Terminates License Agreement with Shiseido

VANCOUVER, BC, CANADA – 21 December 2021 – RepliCel Life Sciences Inc. (OTCPK: REPCF) (TSXV: RP) (FRA:P6P2) (“RepliCel” or the “Company”), a company developing next-generation technologies in aesthetics and orthopedics, announced today that the dispute between Shiseido and RepliCel has led to the Company electing to terminate the license agreement with Shiseido. The Company’s decision is a legal step in its pursuit of a resolution of its disagreement with Shiseido that is the subject of ongoing arbitration proceedings under the aegis of the International Center for Dispute Resolution (ICDR).

The dispute between Shiseido and RepliCel is related to a license for Asia to RepliCel’s cell therapy technology for androgenetic alopecia, which is the leading cause of male and female pattern hair loss. Legal counsel for RepliCel filed a Notice of Arbitration that was announced in a Company press release on October 18, 2021.

https://www.fiercebiotech.com/biotech/replicel-says-hair-loss-therapy-safe-glimmers-efficacy Still feel more optimistic towards Epibiotech rather than Replicel

That’s an old article?

Damn my bad.